(주)피티앤케이 소개

(주)피티앤케이 소개 -

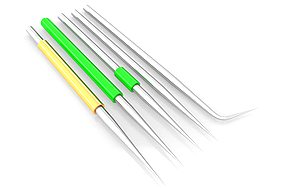

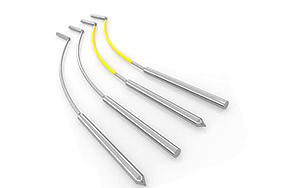

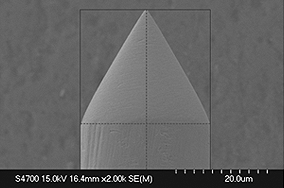

(주)피티앤케이는 반도체 검사에 필요한 핵심부품인

PROBE NEEDLE을 생산하는 ETCHING TECHNOLOGY

전문기업 회사입니다.

제품업무문의

제품업무문의 -

(주)피티앤케이에서 생산되는 제품에 대한

궁금하신 점이나 업무상 문의 하실 내용이 있으시면

온라인문의를 이용하시기 바랍니다.

기술관련 자료실

기술관련 자료실 -

(주)피티앤케이에서 생산되는 제품에 대한 기술관련

자료를 다운받으실 수 있습니다.

원하시는 정보는 자료실을 이용하시기 바랍니다.